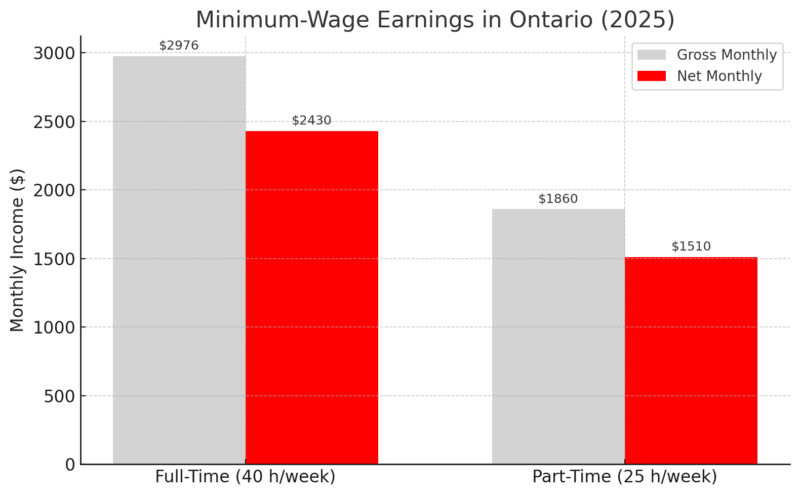

As of 2025, the minimum wage in Ontario stands at $17.20 per hour. For a full-time worker (40 hours/week), that translates to $2,976 per month before taxes or roughly $2,430 after deductions. But can you live in Toronto on that income?

The short answer is: barely — and only with major compromises. While it is technically possible to survive, living independently on minimum wage in Toronto means sacrificing savings, skipping non-essential costs, and likely relying on shared housing or government subsidies.

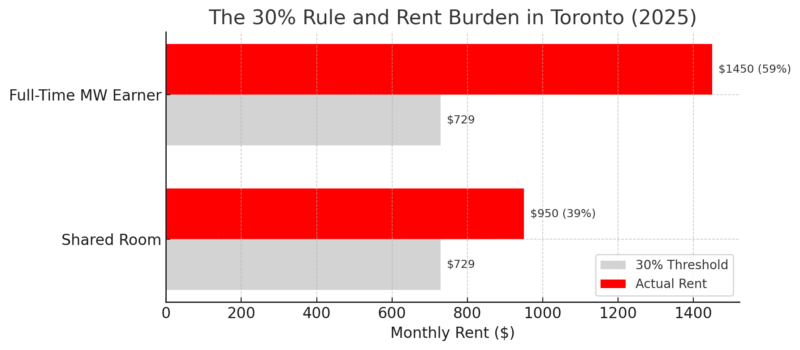

Rent alone can swallow more than 60% of a minimum wage earner’s income, far beyond the affordable housing threshold of 30%.

Table of Contents

ToggleMinimum-Wage Earnings in Ontario (2025)

A full-time minimum-wage earner clocks 2,080 hours per year. At $17.20, gross annual income reaches $35,770, yet roughly 18 % vanishes to income tax, Canada Pension Plan, and Employment Insurance. That leaves a take-home pay of just over $29,000 — about $2,430 each month.

Ontario indexes its minimum wage annually to inflation, but the 2025 bump of 3.5 % lags behind the city’s average rent increase of more than 8 %. The Ontario Living Wage Network pegs Toronto’s living wage for 2025 at $25.75 per hour — nearly 50 % higher than the statutory minimum.

A living wage reflects the hourly rate a worker needs to cover essentials and modest participation in community life without relying on credit or public assistance. In real terms, today’s minimum-wage worker earns about $750 less each month than what local nonprofits deem necessary for basic stability in the city.

Many retail and hospitality employers cap schedules below 30 hours to avoid benefit costs. A worker at 25 hours takes home about $1,510 after tax — barely enough to buy a TTC pass and share a basement room.

For these employees, overtime or a second job becomes essential, yet juggling multiple shifts often incurs extra transit costs and leads to chronically long workweeks without the benefits full-timers receive.

Average Cost of Living for a Single Adult (2025)

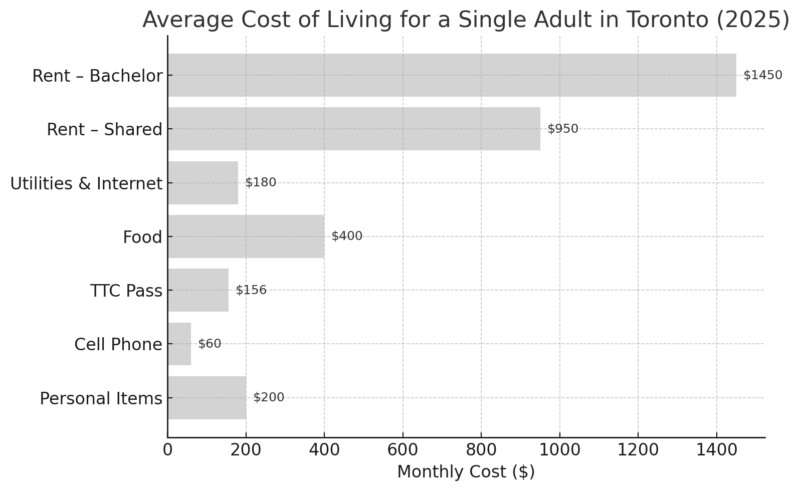

Toronto’s rental market tightened further in 2024–25, with vacancy hovering near 1.2 %. A downtown bachelor averages $1,450, up from about $1,300 two years ago. Even more affordable basement rooms or suburban shares now approach $900–1,000, forcing many workers into longer commutes from Mississauga, Scarborough, or North York to stay afloat.

While $400 per month covers a modest grocery cart anchored by staples and occasional fresh produce, it leaves no room for restaurant meals, workday coffees, or special diets. Food inflation hit 6 % in 2025, meaning items like eggs, cheese, and fruit increased far faster than overall CPI.

Busy minimum-wage earners juggling multiple jobs also face a trade-off: spending more on take-out to save time versus cooking that many simply do not have.

Heat, hydro, and internet average $180 in a bachelor, but poorly insulated older units can spike winter hydro bills over $120 alone. Transit is the lifeline for non-drivers: the TTC pass reached $156 after the March fare hike, and limited GO Transit discounts for low-income adults mean commuters from the 905 pay far more.

Cutting the phone bill by switching to budget carriers saves at most $20–25, yet reliable data is often essential for gig workers who schedule shifts via apps.

What’s Left After the Basics?

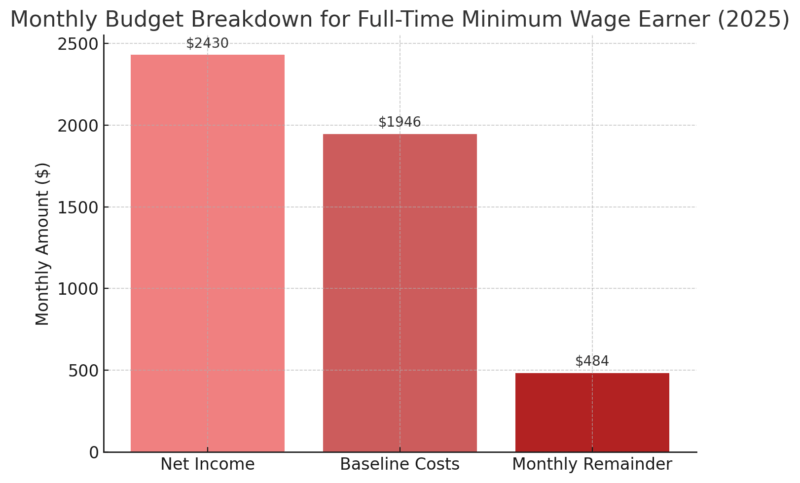

With $484 left after rent, food, transit, and basic utilities, a worker has about $16 per day for everything else: toiletries, clothing, prescriptions, entertainment, gifts, and unexpected fees.

Any dental work, appliance repair, or even replacing a worn-out winter coat can obliterate that buffer in a single swipe of a debit card.

Carrying no credit-card safety net, many low-wage Torontonians rely on payday lenders whose effective APRs top 400%. One late rent cheque or lost shift triggers a cycle of high-interest debt.

Statistics Canada shows that households with incomes under $35,000 spend 8% of their income on interest charges, compared with 2% for middle-income earners — the so-called poverty premium.

Research by the University of British Columbia links chronic financial stress to impaired cognitive bandwidth: budgeting each grocery trip drains mental energy, leaving less focus for job performance or professional development.

Over time, this “scarcity mindset” can entrench people in low-pay trajectories, making economic mobility even harder.

Saving on Minimum Wage: Myth or Possibility?

Target

Ideal Monthly Amount

Feasible on $2,430 Net?

Emergency Fund (10 %)

$243

Difficult

Retirement (RRSP/TFSA)

$150

Rarely

Education/Skill-Building

$100

Unlikely

Financial planners recommend setting aside three months of expenses — roughly $6,000 on this budget. At a painfully modest pace of $100 per month, it would take five years to build.

Most minimum-wage earners face urgent trade-offs: fix a cracked phone screen so they don’t miss work calls, or stash money away for an event that hasn’t happened yet.

A worker who could spare $150 monthly in an RRSP might collect a $300 tax refund come spring, but few can lock money away when day-to-day needs dominate. The result is long-run vulnerability: CPP will not fully replace income, and renters do not build housing equity.

This gap pushes many older low-wage workers to delay retirement or rely on the Guaranteed Income Supplement.

Even inexpensive part-time college certificates cost $300–$500 per course, plus textbooks and transit. Without employer tuition assistance or government grants, skill upgrading feels out of reach, trapping workers in the very wage band that makes saving impossible in the first place.

Government Supports and Tax Credits

Program

Annual Payout

Frequency

Key Eligibility Notes

Canada Workers Benefit

Up to $1,428

Quarterly

Phase-outs above ~$24k income

GST/HST Credit

~$500

Quarterly

Indexed to income and family size

Ontario Trillium Benefit

~$350

Monthly (July–June)

Combines energy + property tax credits

Credits are typically disbursed quarterly in lump sums, which can backstop large bills but aren’t reliable for month-to-month rent. A single adult at $32,000 net may receive roughly $45–$50 per month, averaged out — helpful, but not transformative.

Newcomers or young workers often learn about the CWB only after filing their first tax return, meaning benefits lag by up to 18 months. Filing mistakes, address changes, or missing direct-deposit setup can delay payments further, leaving cash-strapped earners unaware that money is pending.

Toronto offers rent-geared-to-income programs and Housing Allowance supplements, yet the waitlist exceeds 80,000 households with multi-year waits. Private rent-bank grants cover one-time arrears but require proof of a future ability to meet rent, difficult on a minimum wage.

These limits leave many low-income residents stuck in overcrowded conditions or facing eviction notices.

Small Spending Habits Add Up — Including Online Entertainment

For many low-income Torontonians, managing a tight budget doesn’t mean cutting out all non-essentials — it means being extremely selective about affordable ways to unwind. When you’re working long hours on minimum wage, small leisure expenses can feel like the only relief available.

That’s where low-cost entertainment — like inexpensive online gaming — becomes part of the picture.

According to Chief Casinos, gambling services are adapting to low budgets by offering $5 deposit casinos, allowing players to participate with minimal financial commitment. While gambling is never a recommended strategy for income supplementation, these micro-deposit models appeal to budget-conscious individuals looking for low-risk recreation.

Just like with any entertainment expense — whether it’s streaming services, takeout, or mobile games — it’s crucial that spending stays within a clearly defined discretionary budget.

For minimum-wage workers, even small entertainment costs should be planned carefully. With only $400–500 left over each month after essentials, allocating $5–$10 for digital entertainment is manageable only when it doesn’t compromise savings, rent, or food security.

That said, platforms catering to low deposits acknowledge the financial limits of a significant portion of the population, including gig workers and hourly employees who seek modest, accessible forms of relaxation.

The 30 % Rule and Rent Burden

Housing researchers use shelter-to-income ratios to gauge financial stress; households above 50 % are considered severely burdened and at high risk of homelessness. Toronto’s bachelor rent consumes double the benchmark, leaving little doubt about the strain on single earners.

Ontario’s rent-control rules limit increases for sitting tenants, but once a tenant moves out, landlords can raise to the market rate — a policy called vacancy control. This creates an incentive to turn over units and fuels bidding wars among newcomers, pushing average asking rents ever higher.

Some minimum-wage workers seek co-operative housing, micro-suites below 300 sq ft, or multigenerational arrangements. Co-ops offer security at $800–$1,000 per month but have waitlists akin to social housing.

Micro-units rent for less than $1,200 but often lack full kitchens and require creative storage solutions, which not all tenants are willing to accept long-term.

Gig and Part-Time Workers

Worker Type

Net Income

Typical Housing

Net After Essentials

Part-Time Retail (25 h)

$1,510

Shared Room $950

-$390

Ride-Share Driver*

$1,600–1,800

Shared Room $950

~$0–$150

*After fuel, insurance, and maintenance.

Ride-share and food-delivery drivers can gross $22–$25 per hour during peak times, but costs for gas, insurance, and vehicle wear reduce real hourly earnings to roughly $14–$18.

Winter slowdowns or app algorithm changes translate into unpredictable weekly pay, complicating budgeting.

Retail and food-service employers often post schedules mere days in advance. Workers struggle to coordinate second jobs or childcare, leading to involuntary part-time under-employment. Lost shifts equal lost rent money, yet employees have little recourse under current labour laws.

Neither gig contractors nor most part-timers receive paid sick leave, dental plans, or prescription coverage. When flu season strikes, missing work means missing pay. Many continue working ill, risking both public health and personal recovery — another hidden cost of precarious labour.

Real-Life Budget Scenarios (Expanded)

Scenario A – “Roommate Hustle”

A 26-year-old barista shares a two-bedroom at $950 each. After groceries, utilities, and transit, she tucks away $50 a week for future first-and-last-month rent. A cracked wisdom tooth wipes out her savings in one dentist visit, forcing her onto a payment plan that eats the next six months of that modest cushion.

Scenario B – “Solo but in the Red”

A warehouse picker rents a bachelor’s in Etobicoke for $1,450 to live closer to work. After fixed costs, he runs a $70 deficit monthly and floats it on a low-limit credit card. Within a year, interest charges add $600 in debt, and a rent hike pushes him to move farther out, increasing transit time and stress.

Scenario C – “Patchwork Part-Timer”

A college student works 25 retail hours and averages 15 hours with a delivery app. Gross income looks healthy, but the 15 hours come with gasoline costs and Uber fees. Netting out expenses, she clears $1,750, barely breaking even. One parking ticket or car repair could erase her margin for an entire quarter.